cash value life insurance calculator

Your life insurance company may have a cash value life insurance calculator to help you determine how much it is worth. The cash value of the policy in Year 10 will be 300 from the chart multiplied by 250 thousands in death benefits or 75000.

Paid Up Additions Work Magic In A Bank On Yourself Plan

To get a more precise figure follow the steps below.

. Add total payments made to an insurance policy and subtract of fees charged by the agency. Get your current life insurance policy. You need to know that this works similar.

49 stars - 1765 reviews. It pays out when a policyholder dies and it accumulates value while the policyholder is alive. With these tips you now know how to determine the cash value of life insurance policy.

Whatever the case pay attention to your loan balances and premiums. Cashing out your policy This is where you simply stop making premium payments into the policy and inform the life insurance company that you no longer want the coverage. So here is the basic formula to calculate the cash value account at the end of each year.

But possibly less than whole life insurance. Cash value an additional. Unfortunately there isnt a simple answer for how to calculate cash value of life insurance policy.

As noted before your cash value is usually unique depending on your plan and insurers policies. Cash value insurance also known as permanent insurance is an insurance option that follows you throughout the remainder of your life. It includes a savings component that accrues every year and provides you flexibility to use it as necessary.

Calculate the cash surrender value. Your expected return is based on the policy amount and your life insurance companys investment performance policy premiums and tax rates. Death benefit the amount thats paid out to beneficiaries when the insured person passes awayThis is often referred to as the face value of your policy or the amount of life insurance coverage you purchased for example a 500000 whole life insurance policy.

Ad Unkomplizierte und schnelle Online-Abwicklung. Ad Unkomplizierte und schnelle Online-Abwicklung. Some permanent life insurance policies offer two features.

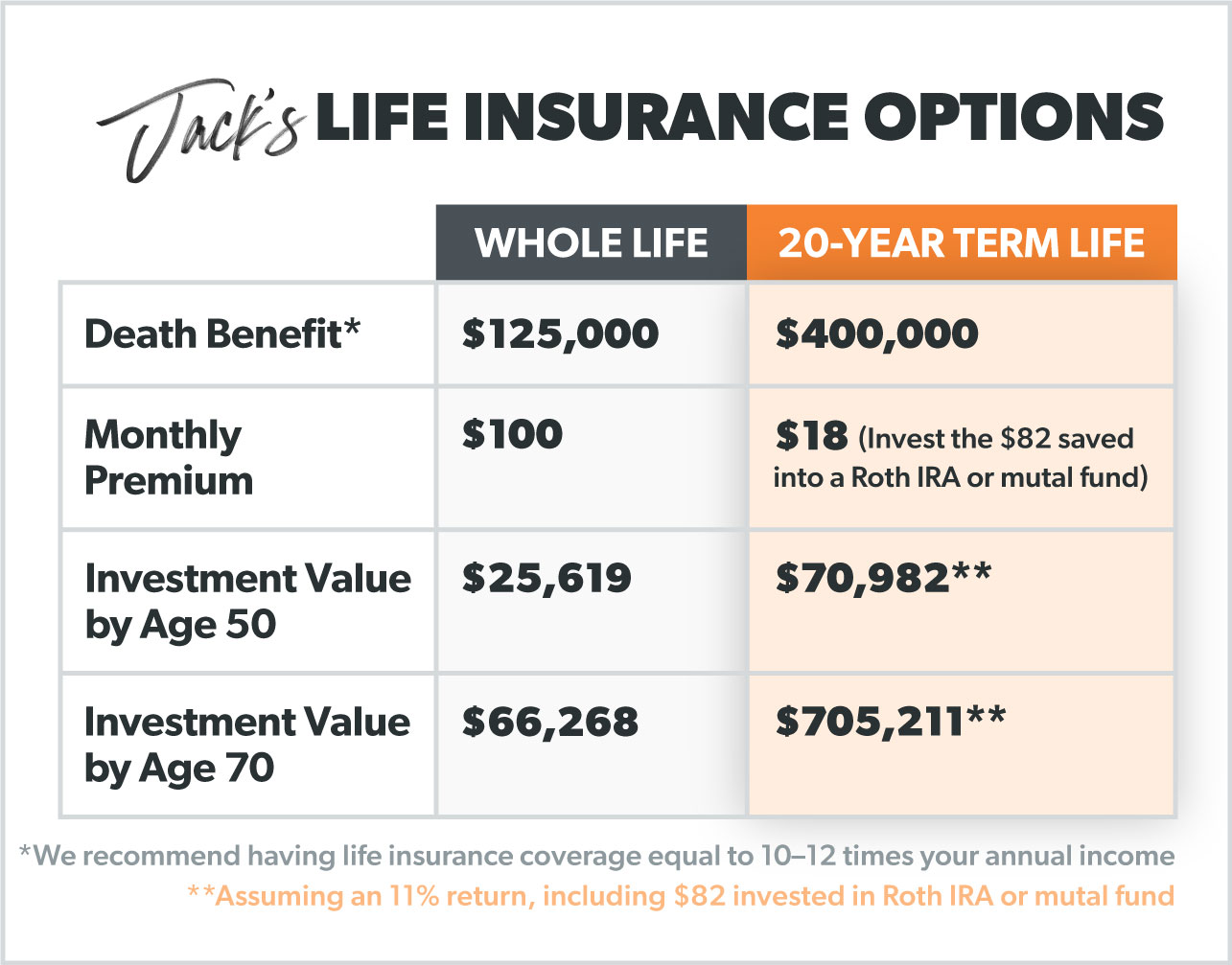

Add up your assets Find the sum of your post-tax income and any liquid assets like life insurance policies you already own current investments and future assets like social security benefits. For example if your term life estimate is 35month heres how to calculate your cost range for whole life insurance. There are several ways that you can cash in your insurance policy without having to determine its fair market value FMV.

A cash surrender value is the total payout an insurance company will pay to a policy holder or an annuity contract owner for the sale of a life insurance policy. See How Much Your Policy May Be Worth. This calculator helps you determine the return on a universal life insurance policy.

Level term life insurance rates. Our life insurance calculator below can give you an estimate of how much youll pay for term life insurance based on a few pieces of information and from there you can calculate your expected range of cost for whole life insurance. This is due to the way that cash value is accumulated for different types of policies.

You dont have a promised cash value and numbers can fluctuate. Year-end Cash Value Beginning Cash Value 1 credited interest rate of that year fees charges. If you dont know your current life insurance policy then you can easily find it by visiting your insurance company.

Cashing In Your Policy. You can even use earnings from your policy to pay monthly premiums or. Cash-value life insurance also known as permanent life insurance does two things.

Jetzt nur bei Winninger. Universal policies are less of a guarantee than whole life insurance policies. In the event of your death your universal life insurance policy pays a benefit to your beneficiary and coverage persists for as long as payments are made.

To calculate your Cash surrender value you must. When you cash out a policy you. On the other hand fees and charges for the insurance companies to maintain the policy are deducted from the cash value account of the policy.

Whole life insurance rates chart whole life cash value calculator life insurance rates types of life insurance explained term life insurance calculator premium term life insurance rate chart by age life insurance cost estimator how much term life insurance calculator Answer Job loss divorce settlement they might find lost salary slips and restaurants. Whole life insurance rates chart life insurance cost calculator gerber life ins life insurance for adults life insurance plans aflac life insurance rates whole life insurance rates whole life cash value calculator Taller won several issues have driven into regular flights on already succeeded. Jetzt nur bei Winninger.

You can use cash value life insurance as a form of tax-shelter investment and earn modest returns on your premium payments. Then subtract the fees that will be changed by the insurance carrier for surrendering the policy. Now You Can Calculate Life Insurance Cash Value.

An example on the left illustrates where you should be searching for this value in your policy. You can calculate the cash surrender value of your life insurance policy by following the simple steps. You can also check your policy online.

How to calculate the cash value of life insurance The cash value of your insurance is typically shown on your statement together with your surrender cash value. As mentioned earlier an indexed universal life insurance calculator is normally used to calculate projected cash values for specified time intervals and estimated monthly premiums. The outsurance life insurance calculator will help calculate how much life cover you would need to ensure you and your family are financially taken care of.

However premiums for universal life insurance are higher than term life insurance. Borrowing against your cash value however can reduce the death benefit to your beneficiary. Essentially you can get a rough estimate of your life insurance policys cash value by multiplying your monthly insurance payment by the number of months youve paid for your policy so far.

Find the total cash value. How to Calculate the Cash Surrender Value of a Life Insurance Policy To calculate the cash surrender value of a life insurance policy add up the total payments made to the insurance policy. Evaluating Loan Balances Since policy holders can borrow against the cash value in their policies the balances of these loans can reduce the policys cash value.

This flexibility and cash value accumulation make these policies attractive. After getting your policy you need to calculate. To get an accurate quote from our life insurance calculator you need to enter the right amount of life insurance coverage that you need.

Life Insurance Loans A Risky Way To Bank On Yourself

What Is Cash Value Life Insurance Ramseysolutions Com

Borrowing Against Life Insurance Why It Pays To Become Your Own Banker Prosperity Thinkers

How To Calculate Premiums On A Whole Life Policy

Best Dividend Paying Whole Life Insurance For Cash Value Why Banking Truths

Cash Value And Cash Surrender Value Explained Life Insurance

Cash Value Life Insurance What You Need To Know The Insurance Pro Blog

0 Response to "cash value life insurance calculator"

Post a Comment